How to Check Your CPF Investment Account?

Why Should You Check Your CPF Investment Account?

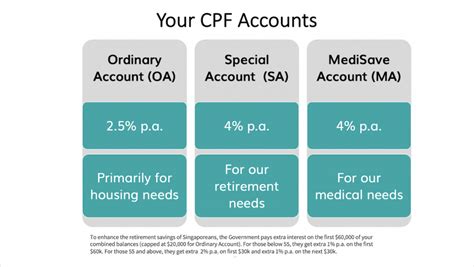

The Central Provident Fund (CPF) is a mandatory savings scheme for Singaporeans and Permanent Residents (PRs). The CPF system comprises three accounts: the Ordinary Account (OA), the Special Account (SA), and the CPF Investment Account (IA). Your CPF IA is meant for your retirement needs.

By checking your CPF IA regularly, you can:

- Track the performance of your investments

- Make informed decisions about your investments

- Adjust your investment strategy accordingly

How to Check Your CPF Investment Account

There are three ways to check your CPF IA:

Online

- Log in to your CPF account at www.cpf.gov.sg.

- Click on the “Investment” tab.

- Select “View My Investments”.

Mobile App

- Download the CPF mobile app from the App Store or Google Play.

- Log in to your CPF account.

- Tap on the “Investment” tab.

- Select “View My Investments”.

At a CPF Service Centre

- Visit any CPF Service Centre.

- Bring your NRIC or passport.

- A staff member will help you to check your CPF IA.

What Information Can You Find in Your CPF Investment Account?

When you check your CPF IA, you will find the following information:

- Your account balance

- The value of your investments

- The performance of your investments

- Your investment history

- Your asset allocation

What Should You Do After Checking Your CPF Investment Account?

After checking your CPF IA, you should take some time to review your investment strategy. Ask yourself the following questions:

- Are you comfortable with the risk level of your investments?

- Are you happy with the performance of your investments?

- Are you making the most of your CPF savings?

If you are not comfortable with the risk level of your investments, you can reduce your risk by investing in less volatile assets, such as bonds. If you are not happy with the performance of your investments, you can consider changing your investment strategy. And if you are not making the most of your CPF savings, you can consider increasing your contributions.

Tips for Checking Your CPF Investment Account

Here are a few tips for checking your CPF IA:

- Check your CPF IA regularly, at least once a year.

- Review your investment strategy regularly and make adjustments as needed.

- Don’t be afraid to ask for help from a financial advisor if you need it.

FAQs

1. How often should I check my CPF IA?

You should check your CPF IA at least once a year. However, you may want to check it more frequently if you are making changes to your investment strategy or if you are concerned about the performance of your investments.

2. What should I do if I am not happy with the performance of my investments?

If you are not happy with the performance of your investments, you can consider changing your investment strategy. You may want to invest in less volatile assets, such as bonds, or you may want to increase your contributions to your CPF IA.

3. Can I withdraw money from my CPF IA?

You can withdraw money from your CPF IA when you reach the age of 55. However, you will have to pay a penalty if you withdraw your money before the age of 65.

4. What happens to my CPF IA when I die?

When you die, your CPF IA will be passed on to your beneficiaries. Your beneficiaries can withdraw the money from your CPF IA or they can use it to purchase a property or to pay for your funeral expenses.

5. What is the difference between the CPF OA, SA, and IA?

The CPF OA is meant for your housing needs. The CPF SA is meant for your retirement needs. The CPF IA is also meant for your retirement needs, but it offers you more investment options.

6. How can I increase my CPF contributions?

You can increase your CPF contributions by topping up your CPF account or by making voluntary contributions.

7. What are the benefits of investing in my CPF IA?

There are several benefits to investing in your CPF IA, including:

- Tax savings

- Potential for higher returns

- Access to a wider range of investment options

8. What are the risks of investing in my CPF IA?

There are some risks associated with investing in your CPF IA, including:

- The value of your investments can go down as well as up

- You may lose money if you withdraw your money before the age of 55

Conclusion

Checking your CPF IA is an important part of managing your retirement savings. By checking your CPF IA regularly, you can track the performance of your investments, make informed decisions about your investments, and adjust your investment strategy accordingly.