How to Set Up PayNow OCBC by 2025: A Comprehensive Guide

Introduction

PayNow is a fast and secure way to send and receive money in Singapore. It is available to all individuals and businesses with a Singapore bank account. OCBC is one of the leading banks in Singapore that offers PayNow services.

Step-by-Step Guide to Setting Up PayNow OCBC

Step 1: Check Eligibility

- Ensure you have a valid OCBC bank account.

- Your mobile number must be registered with OCBC.

Step 2: Download the OCBC Mobile App

- Search for “OCBC Digital” or “OCBC PayAnyone” on the App Store or Google Play.

- Download and install the app.

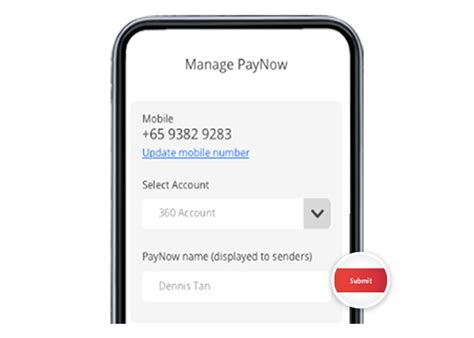

Step 3: Sign Up for PayNow

- Open the OCBC Mobile App.

- Tap on the “Pay & Request” tab.

- Select “PayNow.”

- Enter your mobile number.

- Create a 6-digit PayNow PIN.

Step 4: Enable PayNow Funds Transfer

- Tap on “My Accounts” in the OCBC Mobile App.

- Select your OCBC bank account.

- Scroll down to “PayNow Funds Transfer” and tap on “Enable.”

- Enter your PayNow PIN for confirmation.

Step 5: Add Recipients

- Tap on “Add Recipient” in the PayNow section of the OCBC Mobile App.

- Enter the recipient’s mobile number or NRIC.

- Select the recipient’s account type (personal or business).

- Confirm the details and tap on “Add.”

Using PayNow OCBC

- Sending Money: Tap on “PayNow” in the OCBC Mobile App, enter the recipient’s details, amount, and payment reference.

- Receiving Money: PayNow funds will be credited directly to your OCBC bank account. You will receive an SMS notification for each transaction.

Benefits of Using PayNow OCBC

- Fast and Convenient: PayNow transactions are processed in real-time.

- Secure: PayNow uses strong encryption to protect your financial information.

- Easy to Use: The PayNow interface is user-friendly and designed for ease of use.

- No Transaction Fees: PayNow transactions are free for both senders and receivers.

Comparison: PayNow OCBC vs. Other Banks

| Feature | OCBC | Other Banks |

|---|---|---|

| Transaction Fees | Free | May charge fees |

| Convenience | OCBC Mobile App | Mobile apps or online banking |

| Security | 6-digit PayNow PIN | Bank-specific security measures |

| Customer Support | 24/7 hotline | Varies by bank |

FAQs

1. Can I set up PayNow without an OCBC bank account?

No, you must have an OCBC bank account to set up PayNow.

2. What is the maximum amount I can transfer using PayNow?

The maximum amount per transaction is S$1,000,000.

3. Can I send money overseas using PayNow?

No, PayNow is currently only available for transactions within Singapore.

4. How do I reset my PayNow PIN?

If you forget your PayNow PIN, you can reset it through the OCBC Mobile App. Tap on “Forgot PayNow PIN” and follow the instructions.

5. Can I use PayNow to pay bills?

Yes, you can use PayNow to pay bills to companies that offer this service.

6. How secure is PayNow?

PayNow uses strong encryption to protect your financial information. Transactions are processed through a secure network and are monitored for fraud.

Highlights of PayNow OCBC

- Easy setup: Quick and seamless enrollment process through the OCBC Mobile App.

- Real-time payments: Transfers are processed instantly, providing immediate access to funds.

- Cost-effective: No transaction fees for both senders and receivers.

- Wide acceptance: PayNow is widely accepted by merchants and businesses across Singapore.

- Comprehensive support: 24/7 customer support available to assist users with any queries or issues.

Conclusion

Setting up PayNow OCBC is a straightforward process that takes only a few minutes. Once set up, you can enjoy the convenience and security of sending and receiving money instantly. Whether you’re making purchases, paying bills, or splitting expenses, PayNow OCBC offers a fast, affordable, and reliable payment solution.