Is Bank Overdraft a Current Liability? VS. 2025

Introduction

Bank overdraft, a common financial tool, allows individuals to spend beyond the available balance in their checking accounts. But is it considered a current liability? This article explores the nature of bank overdrafts and their classification within financial statements.

Current Liability: Definition

A current liability is a short-term obligation that a company expects to settle within one year or the operating cycle, whichever is longer. According to the Financial Accounting Standards Board (FASB), liabilities are classified as current or noncurrent based on their timing of settlement.

Bank Overdraft: Characteristics

Bank overdrafts share similarities with current liabilities:

- Short-term: Overdrafts are typically repaid within a short period, usually within 30-60 days.

- Obligation: Bank customers who overdraw their accounts have an obligation to repay the borrowed funds.

- Settlement: Overdrafts are settled directly by the bank when funds become available in the customer’s account.

Classification as a Current Liability

Given these characteristics, bank overdrafts meet the criteria for current liabilities because they:

- Are expected to be settled within one year.

- Are an obligation created by the customer’s actions.

- Will be settled directly by the bank using available funds.

Comparisons with Other Liabilities

- Credit Card Debt: Similar to overdrafts, credit card debt is a short-term obligation with a repayment period typically less than one year. However, credit card debt is typically not included in current liabilities as it is a separate loan product.

- Short-Term Loans: Unlike overdrafts, which are typically informal arrangements with low interest rates, short-term loans are formal agreements with specific loan terms and higher interest rates. However, both are considered current liabilities.

- Accounts Payable: Accounts payable are short-term obligations to suppliers or vendors. They are incurred when a company receives goods or services on credit and are expected to be settled within the company’s normal operating cycle. Like overdrafts, accounts payable are classified as current liabilities.

Implications for Financial Reporting

Classifying bank overdrafts as current liabilities has several implications for financial reporting:

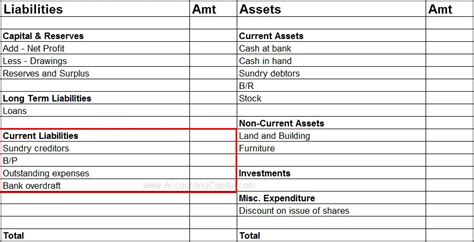

- Balance Sheet: Overdrafts are reported as a line item under current liabilities on the company’s balance sheet.

- Income Statement: Interest expenses incurred on overdrafts are recognized as interest expense in the income statement.

- Financial Ratios: Bank overdrafts can affect financial ratios that measure liquidity and solvency, such as the current ratio and debt-to-equity ratio.

Conclusion

Bank overdrafts are indeed considered current liabilities due to their short-term nature, obligation to repay, and expected settlement within one year. This classification has implications for financial reporting, affecting the balance sheet, income statement, and financial ratios. Understanding the classification of bank overdrafts is crucial for accurate financial reporting and analysis.

Additional Considerations

- Overdraft Protection: Some banks offer overdraft protection, where customers can link an external account to automatically cover overdrafts. This service may prevent the customer from incurring service charges but may also result in higher fees.

- Alternatives to Overdrafts: Alternative funding options, such as personal loans or lines of credit, may offer lower interest rates and longer repayment periods than overdrafts.

- Managing Overdrafts: To avoid excessive overdraft charges, it is essential to monitor account balances regularly, budget carefully, and consider alternative funding options.

Tables

| Bank Overdraft | Current Liability | Relevant Characteristics |

|---|---|---|

| Temporary borrowing | Yes | Short-term obligation, due within one year |

| Obligation to repay | Yes | Bank expects repayment when funds become available |

| Settled directly by bank | Yes | Funds withdrawn directly from customer’s account |

| Liability Type | Repayment Period | Classification |

|---|---|---|

| Credit Card Debt | Typically less than one year | Not included in current liabilities |

| Short-Term Loan | Specific loan terms | Current liability |

| Accounts Payable | Normal operating cycle | Current liability |

FAQs

-

Why is a bank overdraft considered a current liability?

– Bank overdrafts are expected to be settled within one year and represent an obligation to repay borrowed funds. -

What are the implications of classifying bank overdrafts as current liabilities?

– They are reported on the balance sheet as a current liability and can impact financial ratios. -

Are there any alternatives to using bank overdrafts?

– Yes, personal loans or lines of credit may offer more favorable terms. -

How can I avoid excessive overdraft charges?

– Monitor your account balance, budget carefully, and consider alternative funding options. -

What is the difference between bank overdrafts and credit card debt?

– Credit card debt is a separate loan product, while overdrafts are an informal arrangement with low interest rates. -

Are bank overdrafts included in current liabilities for financial reporting purposes?

– Yes, bank overdrafts are reported as a line item under current liabilities.

Conclusion

Understanding the classification of bank overdrafts as current liabilities is crucial for accurate financial reporting and analysis. By considering the characteristics and implications of overdrafts, individuals and organizations can make informed decisions about their financial management.