Financial Advisor Business Plan Sample PDF

Introduction

The financial advisory industry is constantly evolving, and advisors who want to succeed in 2025 and beyond need to have a solid business plan in place.

1. Executive Summary

The executive summary should provide a brief overview of your business plan, including your mission statement, target market, and financial goals.

2. Market Analysis

The market analysis should describe the current state of the financial advisory industry, including the challenges and opportunities that advisors face.

3. Competitive Landscape

The competitive landscape should identify your competitors, their strengths and weaknesses, and your competitive advantage.

4. Business Model

The business model should describe how you plan to generate revenue and profit, including your fee structure and target client base.

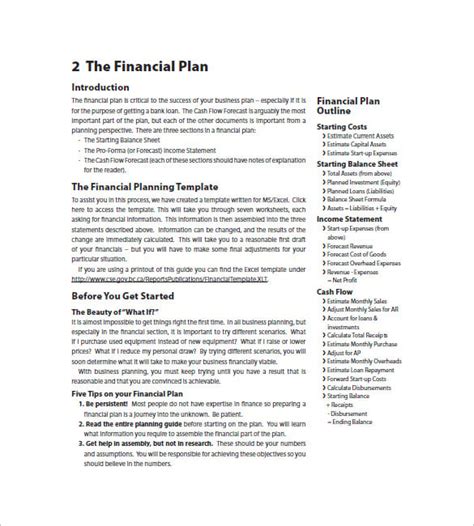

5. Financial Planning

The financial planning section should include your financial projections, including your income, expenses, and profitability.

6. Marketing and Sales

The marketing and sales section should describe how you plan to market your business and generate leads, including your target audience, marketing channels, and sales process.

7. Operations and Management

The operations and management section should describe how you plan to run your business, including your staffing, technology, and compliance procedures.

8. Risk Management

The risk management section should identify the risks that your business faces and how you plan to mitigate them, including your risk management policies and procedures.

9. Exit Strategy

The exit strategy should describe how you plan to exit your business, including your timeline, potential buyers, and financial considerations.

10. Appendix

The appendix should include any supporting documents, such as your financial statements, marketing materials, and compliance documents.

Financial Advisor Business Plan Sample PDF

A business plan is a roadmap for your business. It helps you define your goals, identify your target market, and develop a strategy for reaching your objectives.

Here are some of the benefits of having a business plan:

- It can help you get financing.

- It can attract new clients.

- It can help you stay organized and on track.

- It can help you identify opportunities and threats.

- It can help you make better decisions.

If you’re a financial advisor, it’s important to have a business plan in place. A well-written business plan can help you:

- Attract new clients.

- Increase your revenue.

- Improve your profitability.

- Build a strong reputation.

- Achieve your long-term goals.

Here are some of the key components of a financial advisor business plan:

- Executive summary

- Market analysis

- Competitive landscape

- Business model

- Financial planning

- Marketing and sales

- Operations and management

- Risk management

- Exit strategy

Appendix

The appendix should include any supporting documents, such as your financial statements, marketing materials, and compliance documents.

How to Write a Financial Advisor Business Plan

Writing a financial advisor business plan can be a daunting task, but it doesn’t have to be.

Here are some tips for getting started:

- Start with a strong executive summary.

- Do your research and write a comprehensive market analysis.

- Identify your target market and develop a competitive landscape.

- Choose a business model that fits your goals and objectives.

- Develop a comprehensive financial plan.

- Create a marketing and sales plan that will help you reach your target audience.

- Develop operations and management procedures that will ensure your business runs smoothly.

- Identify the risks that your business faces and develop a risk management plan.

- Think about your exit strategy and include it in your business plan.

- Get feedback from other financial advisors or business professionals.

Free Financial Advisor Business Plan Template

Once you’ve gathered all of the necessary information, you can start writing your financial advisor business plan. Here are some tips for writing a strong business plan:

- Be clear and concise.

- Use strong verbs and active voice.

- Use data to support your claims.

- Proofread your business plan carefully before submitting it.

Getting Help with Your Financial Advisor Business Plan

If you need help writing your financial advisor business plan, there are a number of resources available to you.

- You can hire a business plan writer.

- You can attend a business planning workshop.

- You can get feedback from other financial advisors or business professionals.

No matter how you choose to write your financial advisor business plan, make sure it’s a document that you’re proud of. Your business plan will be a valuable tool for you as you grow your business.

Financial Advisor Business Plan Example

Here is an example of a financial advisor business plan:

Executive Summary

The mission of [Your Business Name] is to provide comprehensive financial planning services to individuals and families. We believe that everyone deserves access to sound financial advice, regardless of their income or net worth.

Our target market is individuals and families who are looking for help with financial planning, retirement planning, investment management, and estate planning. We offer a variety of services to meet the needs of our clients, including:

- Financial planning

- Retirement planning

- Investment management

- Estate planning

- Insurance planning

We are committed to providing our clients with the highest level of service. We are independent and objective, and we always put our clients’ interests first.

Market Analysis

The financial advisory industry is growing rapidly. According to the Bureau of Labor Statistics, the number of financial advisors is projected to grow by 7% from 2019 to 2029.

This growth is being driven by a number of factors, including:

- The aging population

- The increasing complexity of financial markets

- The growing need for financial planning

Competitive Landscape

The financial advisory landscape is competitive. There are a number of large, national financial advisory firms, as well as many smaller, regional firms.

Our competitive advantage is our focus on providing personalized service to our clients. We take the time to get to know our clients and their financial goals. We then develop customized financial plans that are designed to meet their specific needs.

Business Model

Our business model is based on providing fee-based financial planning services to our clients. We do not sell products or receive commissions from third parties.

We believe that this fee-based model aligns our interests with our clients’ interests. We are not incentivized to sell our clients products or services that they do not need.

Financial Planning

Our financial planning process begins with a complimentary consultation. During this consultation, we will get to know you and your financial goals. We will then develop a customized financial plan that is designed to meet your specific needs.

Our financial plans typically include the following components:

- A review of your current financial situation

- A discussion of your financial goals

- A recommended course of action

- A monitoring and review process

Marketing and Sales

Our marketing and sales efforts are focused on reaching our target market. We use a variety of marketing channels to reach our target audience, including:

- Online marketing

- Social media marketing

- Content marketing

- Referrals

We also participate in a number of community events and activities. This helps us to build relationships with potential clients and to establish ourselves as a trusted source of financial advice.

Operations and Management

Our operations and management procedures are designed to ensure that our business runs smoothly and efficiently. We have a team of experienced financial advisors who are committed to providing our clients with the highest level of service.

We also use a variety of technology tools to help us manage our business. This helps us to streamline our processes and to provide our clients with the best possible experience.

Risk Management

We have a comprehensive risk management plan in place to identify and mitigate the risks that our business faces. Our risk management plan includes the following components:

- A risk assessment

- A risk management strategy

- A risk monitoring and review process

Exit Strategy

Our exit strategy is to sell our business to a larger financial advisory firm. We believe that this will be the best way to ensure that our clients continue to receive the highest level of service.

Appendix

The appendix includes the following supporting documents:

- Our financial statements

- Our marketing materials

- Our compliance documents

FAQs

1. What is a financial advisor business plan?

A financial advisor business plan is a roadmap for your business. It helps you define your goals, identify your target market, and develop a strategy for reaching your objectives.

2. Why do I need a financial advisor business plan?

A well-written business plan can help you:

- Attract new clients.

- Increase your revenue.

- Improve your profitability.

- Build a strong reputation.

- Achieve your long-term goals.

3. How do I write a financial advisor business plan?

Here are some tips for writing a financial advisor business plan:

- Start with a strong executive summary.

- Do your research and write a comprehensive market analysis.

- Identify your target market and develop a competitive landscape.

- Choose a business model that fits your goals and objectives.

- Develop a comprehensive financial plan.

- Create a marketing and sales plan that will help you reach your target audience.

- Develop operations and management procedures that will ensure your business runs smoothly.

- Identify the risks that your business faces and develop a risk management plan.

- Think about your exit strategy and include it in your