How to Start a Business in Singapore in 2025: Compare & VS

Introduction

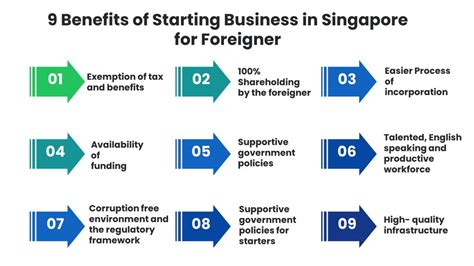

Singapore is a thriving business hub with a supportive ecosystem for entrepreneurs. Establishing a business in Singapore offers numerous advantages, including a favorable tax regime, a skilled workforce, and a strategic location.

1. Determine Your Business Structure

The first step is to choose the appropriate business structure. Singapore offers various options, each with its advantages and disadvantages:

2. Sole Proprietorship

- Simplest structure

- No legal distinction between the business and owner

- Liable for all business debts

3. Partnership

- Involves two or more individuals sharing a common goal

- Profits and losses are shared among partners

- Partners are jointly liable for business debts

4. Private Limited Company (Pte. Ltd.)

- Separate legal entity from the owner(s)

- Owners are shareholders with limited liability

- Requires a minimum of one director and shareholder

5. Limited Liability Partnership (LLP)

- Hybrid structure combining features of a partnership and a company

- Partners have limited liability

- Profits and losses are allocated based on agreed ratios

3. Business Registration

6. Register Your Company

Once you have determined the business structure, you must register your company with the Accounting and Corporate Regulatory Authority (ACRA). The registration process involves:

- Submitting a registration form

- Providing details of the business, directors, and shareholders

- Paying the prescribed fees

7. Obtain Necessary Licenses and Permits

Depending on the nature of your business, you may need to obtain specific licenses or permits from relevant government agencies. For example:

- Food and beverage establishments require a food establishment license

- Educational institutions require a private school license

- Financial service providers require a Capital Markets Services License

4. Open a Business Bank Account

8. Choose a Bank

Singapore has a well-developed banking sector offering a wide range of services. Compare different banks based on factors such as account fees, interest rates, and online banking capabilities.

9. Open an Account

To open a business bank account, you will need to provide documentation such as your business registration certificate, company constitution, and a passport or identity card.

5. Build Your Team

10. Hire Employees

Singapore has a highly skilled workforce. To attract and retain talented employees, consider offering competitive salaries, comprehensive benefits, and a positive work environment.

11. Outsource Services

If you lack the expertise or resources to perform certain functions, consider outsourcing to third-party providers. This can help you save time and costs.

6. Market Your Business

12. Develop a Marketing Strategy

Identify your target audience and develop a marketing strategy that aligns with their needs and preferences. Utilize a combination of online and offline marketing channels.

13. Build an Online Presence

Create a website and active social media accounts to establish an online presence for your business. Use these platforms to connect with potential customers and build brand awareness.

7. Manage Your Finances

14. Track Expenses

Keep accurate records of all business expenses to monitor cash flow and identify areas for cost optimization. Use accounting software or hire an accountant to manage your finances.

15. Manage Taxes

Singapore has a low tax rate of 17% for corporate income. Ensure you understand your tax obligations and file your returns on time to avoid penalties.

8. Stay Updated

16. Monitor Market Trends

Stay informed about the latest market trends, technological advancements, and regulatory changes that may impact your business. Adapt your strategies as needed to remain competitive.

17. Seek Professional Advice

Consult with lawyers, accountants, or business advisors to gain insights and guidance on legal, financial, and operational matters.

9. Conclusion

Starting a business in Singapore in 2025 requires careful planning and execution. By following the steps outlined above, you can increase your chances of success in this vibrant business environment. Remember to seek professional advice, adapt to changing market conditions, and constantly innovate to stay ahead of the competition.

Tables:

| Business Structure | Advantages | Disadvantages |

|---|---|---|

| Sole Proprietorship | Simple setup | Unlimited liability |

| Partnership | Shared responsibility | Joint liability |

| Private Limited Company | Limited liability | Requires shareholder |

| Limited Liability Partnership | Flexible | Some personal liability |

| Licenses and Permits | Required by | Types of Businesses |

|---|---|---|

| Food Establishment License | ACRA | Restaurants, cafes |

| Private School License | Ministry of Education | Educational institutions |

| Capital Markets Services License | Monetary Authority of Singapore | Financial service providers |

| Marketing Channels | Advantages | Disadvantages |

|---|---|---|

| Online Marketing | Wide reach | Can be costly |

| Offline Marketing | Local reach | Limited exposure |

| Social Media Marketing | Cost-effective | Requires active engagement |

| Strategies for Financial Success | Benefits | Challenges |

|---|---|---|

| Track Expenses | Identifies cost-saving opportunities | Time-consuming |

| Manage Taxes | Avoids penalties | Complex tax laws |

| Seek Professional Advice | Reduces risks | Can be expensive |