Individual Financial COI vs. 2025: A Comprehensive Guide

Introduction

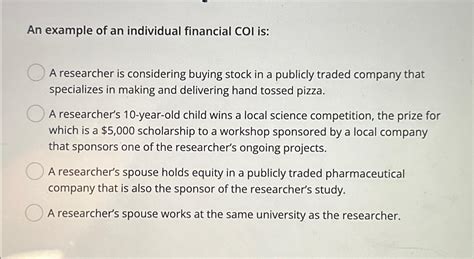

A conflict of interest (COI) occurs when an individual’s personal financial interests could potentially impair their ability to make unbiased decisions. In the context of personal finance, this can arise in various situations, affecting the decisions made regarding investments, insurance, and other financial matters.

Types of Individual Financial COIs

1. Undisclosed Compensation

- Receiving payments or gifts from a financial institution or advisor in exchange for promoting or recommending their products.

- This undisclosed compensation can create a bias towards recommending the products even if they may not be the best fit for the client.

2. Personal Relationships

- Having close relationships with financial professionals, such as family members or friends, who may influence the individual’s financial decisions.

- Emotions and loyalty can cloud judgment and lead to decisions based on personal connections rather than financial merits.

3. Dual Responsibilities

- Serving on the board of directors or having ownership in a financial institution while simultaneously providing financial advice to clients.

- This potential conflict of interest arises when the individual’s loyalty to the financial institution could compromise their advice to clients.

Consequences of Individual Financial COIs

- Biased Decision-Making: COIs can lead to decisions that are not in the best interests of the individual.

- Loss of Trust: When individuals discover COIs, they may lose trust in the advice they receive and the financial professional providing it.

- Reputational Damage: Financial professionals with COIs risk damaging their reputation and losing credibility in the industry.

Mitigating Individual Financial COIs

To minimize the impact of COIs, individuals should:

- Disclosure: Disclose any potential conflicts of interest to clients and seek independent advice if necessary.

- Transparency: Maintain open communication with clients about their compensation and relationships.

- Avoid Dual Roles: Limit dual responsibilities that could create conflicts between personal interests and client obligations.

- Seek Training: Educate themselves on ethical guidelines and best practices to manage COIs effectively.

Upcoming Challenges for 2025

The evolving landscape of the financial industry poses new challenges for managing COIs in 2025.

- Increased Complexity: Financial products and investment strategies become increasingly complex, making it more difficult to assess potential conflicts of interest.

- Digitalization: The growth of digital financial services and online financial advice creates new avenues for COIs to arise.

- Regulatory Changes: Regulatory changes are expected to increase the scrutiny of financial professionals and require more robust conflict management practices.

Conclusion

Understanding and managing individual financial COIs is crucial to protect the interests of both individuals and the financial industry. By adhering to ethical guidelines, fostering transparency, and seeking independent advice when necessary, individuals can mitigate the risks associated with COIs and make informed financial decisions that align with their best interests.