Mathematics of Investment Problems with Solutions 2025

Introduction:

Managing your finances wisely is crucial for securing your financial future. Investments play a vital role in achieving financial goals, whether it’s saving for retirement, building an emergency fund, or simply growing your wealth. Understanding the mathematics behind investment problems is essential for making informed decisions.

Types of Investment Problems:

There are various types of investment problems, including:

- Compound Interest: Calculating the growth of an investment over time with interest reinvested.

- Present Value: Determining the current worth of a future sum of money.

- Future Value: Estimating the value of an investment at a specific point in the future.

- Annuity: Calculating the value of a series of equal payments made over a specified period.

- Bond Valuation: Determining the fair market value of bonds.

Mathematical Formulas:

1. Compound Interest:

- Formula: A = P(1 + r/n)^(nt)

- P: Principal amount

- r: Annual interest rate

- n: Number of times interest is compounded per year

- t: Number of years

2. Present Value:

- Formula: PV = FV / (1 + r)^t

- PV: Present value

- FV: Future value

- r: Annual interest rate

- t: Number of years

3. Future Value:

- Formula: FV = PV(1 + r)^t

- PV: Present value

- FV: Future value

- r: Annual interest rate

- t: Number of years

4. Annuity:

- Formula: PV = PMT * [(1 – (1 + r)^-t) / r]

- PV: Present value

- PMT: Regular payment

- r: Annual interest rate

- t: Number of years

5. Bond Valuation:

- Formula: PV = ∑[(C / r) * (1 – (1 + r)^-t) / r] + (FV / (1 + r)^t)

- PV: Present value

- C: Annual coupon payment

- r: Annual coupon rate

- t: Number of years to maturity

- FV: Face value

Problem-Solving Examples:

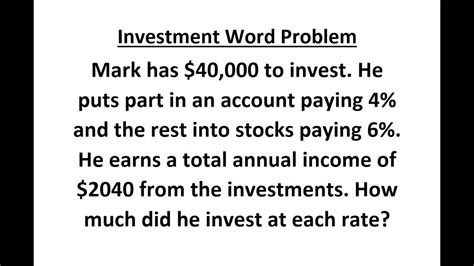

Problem 1:

An investor invests $10,000 at an annual interest rate of 5% compounded monthly. What will be the value of the investment after 5 years?

Solution:

Using the compound interest formula,

PV = $10,000

r = 0.05 / 12

n = 12

t = 5

A = $12,833.58

Problem 2:

A person wants to receive $100,000 in 10 years. How much should they invest today at an annual interest rate of 3% compounded quarterly?

Solution:

Using the present value formula,

FV = $100,000

r = 0.03 / 4

t = 10

PV = $76,290.01

Problem 3:

An annuity pays $1,000 every year for 20 years. If the annual interest rate is 4%, what is the present value of the annuity?

Solution:

Using the annuity formula,

PMT = $1,000

r = 0.04

t = 20

PV = $15,620.33

Applications in Real-Life Scenarios:

Understanding the mathematics of investment problems allows individuals to:

- Plan for retirement and estimate the savings needed.

- Create emergency funds to cover unexpected expenses.

- Invest in stocks, bonds, and real estate for long-term wealth growth.

- Make informed decisions about loans, mortgages, and other financial obligations.

- Manage risk and protect investments from losses.

Pain Points and Motivations:

Pain Points:

- Difficulty in understanding complex financial concepts.

- Lack of knowledge about investment options and their returns.

- Fear of making poor investment decisions.

- Limited access to financial education and resources.

Motivations:

- Desire for financial security and independence.

- Goal to build wealth and achieve financial success.

- Need to plan for the future and avoid financial stress.

- Aspiration to maximize returns and multiply investments.

Step-by-Step Approach:

Step 1: Identify the type of investment problem you need to solve.

Step 2: Determine the relevant mathematical formula.

Step 3: Gather the necessary data and plug it into the formula.

Step 4: Calculate the solution.

Step 5: Interpret the result and make informed decisions.

Highlights:

- The mathematics of investment problems provides a structured approach to financial planning.

- By understanding these formulas, individuals can optimize their investments and maximize returns.

- It empowers investors with the knowledge and confidence to manage their finances effectively.

Future Trending:

As technology evolves, the future of investment problem-solving will likely include:

- Artificial Intelligence (AI): AI-powered tools can analyze vast amounts of data and provide insights and recommendations for investments.

- Automated Trading: Algorithms can be used to make investment decisions based on predetermined criteria, reducing human error.

- Blockchain Technology: Blockchain-based platforms can provide secure and transparent records of investments and transactions.

Conclusion:

The mathematics of investment problems is an essential tool for anyone seeking to achieve financial success. By understanding the formulas and concepts, individuals can make informed decisions about their investments, plan for the future, and maximize their returns. With the advent of technology, the future of investment problem-solving holds exciting prospects, further empowering investors to navigate the complexities of financial markets.