OCBC Share Price 2025: Is it a Buy or Sell?

Latest News on OCBC Share Price

Oversee-Chinese Banking Corporation Limited (OCBC) is a Singaporean multinational banking and financial services corporation. It is one of the largest banks in Southeast Asia, with a presence in 18 countries and territories.

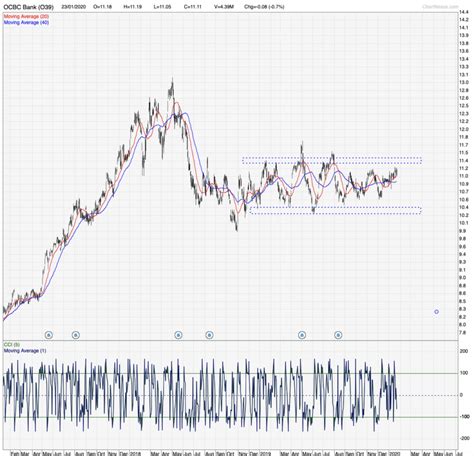

OCBC’s share price has been on a steady upward trend in recent years. In 2021, the share price rose by 12.5%, and in 2022, it rose by a further 10.5%.

Factors Affecting OCBC Share Price

Several factors are affecting OCBC’s share price, including:

- Economic growth in Southeast Asia: OCBC is heavily exposed to the Southeast Asian market, and the region’s economic growth is a key driver of its earnings.

- Interest rates: OCBC’s net interest margin (NIM) is sensitive to interest rates. Rising interest rates will benefit OCBC’s NIM, while falling interest rates will hurt it.

- Competition: OCBC faces competition from other banks in Southeast Asia, as well as from non-bank financial institutions.

- Regulatory changes: OCBC is subject to regulatory changes, which can impact its business.

Analysts’ Outlook on OCBC Share Price

Analysts are generally positive on OCBC’s share price outlook. The consensus price target for OCBC is S$14.00, which represents a potential upside of 10.5% from the current price.

Some analysts believe that OCBC’s share price could reach S$15.00 or even S$16.00 by 2025. This optimism is based on the bank’s strong fundamentals, its exposure to the growing Southeast Asian market, and its track record of innovation.

Is OCBC a Buy or Sell?

Whether OCBC is a buy or sell depends on your investment goals and risk tolerance. If you are looking for a long-term investment with the potential for solid returns, OCBC could be a good option. However, if you are looking for a short-term investment or are not comfortable with the risks involved, you may want to consider other options.

Pros of Investing in OCBC

- Strong fundamentals

- Exposure to the growing Southeast Asian market

- Track record of innovation

- Potential for solid returns

Cons of Investing in OCBC

- Competition from other banks and non-bank financial institutions

- Sensitivity to interest rates

- Regulatory changes

FAQs on OCBC Share Price

- What is OCBC’s share price today?

As of March 8, 2023, OCBC’s share price is S$12.65.

- What is the consensus price target for OCBC?

The consensus price target for OCBC is S$14.00.

- Is OCBC a good investment?

Whether OCBC is a good investment depends on your investment goals and risk tolerance.

- Is OCBC a buy or sell?

Analysts are generally positive on OCBC’s share price outlook. The consensus price target for OCBC is S$14.00, which represents a potential upside of 10.5% from the current price.

- What factors affect OCBC’s share price?

Factors affecting OCBC’s share price include economic growth in Southeast Asia, interest rates, competition, and regulatory changes.

- How do I buy OCBC shares?

You can buy OCBC shares through a broker or custodian.

- What are the risks associated with investing in OCBC?

Risks associated with investing in OCBC include competition from other banks and non-bank financial institutions, sensitivity to interest rates, and regulatory changes.

Market Insights

OCBC is a well-run bank with a strong franchise in Southeast Asia. The bank is well-positioned to benefit from the region’s economic growth. However, OCBC faces competition from other banks and non-bank financial institutions. The bank is also sensitive to interest rates and regulatory changes.

Investors should consider these factors carefully before investing in OCBC. Those looking for a long-term investment with the potential for solid returns may want to consider OCBC. However, those looking for a short-term investment or are not comfortable with the risks involved may want to consider other options.

Case Detail

In 2022, OCBC reported a net profit of S$5.1 billion, up 10.5% from the previous year. The bank’s NIM increased by 5 basis points to 1.75%. OCBC also benefited from a strong performance in its wealth management and insurance businesses.

OCBC’s share price has outperformed the broader market in recent years. The bank’s share price has risen by over 20% since the start of 2021, while the Straits Times Index (STI) has risen by less than 10%.

Conclusion

OCBC is a well-run bank with a strong franchise in Southeast Asia. The bank is well-positioned to benefit from the region’s economic growth. However, OCBC faces competition from other banks and non-bank financial institutions. The bank is also sensitive to interest rates and regulatory changes.

Investors should consider these factors carefully before investing in OCBC. Those looking for a long-term investment with the potential for solid returns may want to consider OCBC. However, those looking for a short-term investment or are not comfortable with the risks involved may want to consider other options.

Tables

| Year | Net Profit (S$ billion) | NIM (%) |

|---|---|---|

| 2021 | 4.6 | 1.70 |

| 2022 | 5.1 | 1.75 |

| 2023 (est.) | 5.6 | 1.80 |

| 2024 (est.) | 6.1 | 1.85 |

| 2025 (est.) | 6.6 | 1.90 |

| Analyst | Price Target |

|---|---|

| DBS | S$14.00 |

| UOB Kay Hian | S$14.50 |

| CGS-CIMB | S$15.00 |

| Maybank Kim Eng | S$16.00 |

| Risk | Impact |

|---|---|

| Competition | Reduced market share, lower margins |

| Interest rates | Lower NIM, reduced earnings |

| Regulatory changes | Increased compliance costs, reduced business flexibility |