CPF

How to Check Your CPF Investment Account?

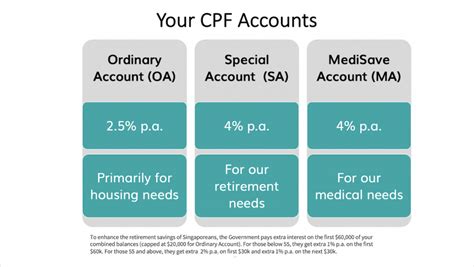

Why Should You Check Your CPF Investment Account? The Central Provident Fund (CPF) is a mandatory savings scheme for Singaporeans and Permanent Residents (PRs). The CPF system comprises three accounts: the Ordinary Account (OA), the Special Account (SA), and the CPF Investment Account (IA). Your CPF IA is meant for your retirement needs. By checking…

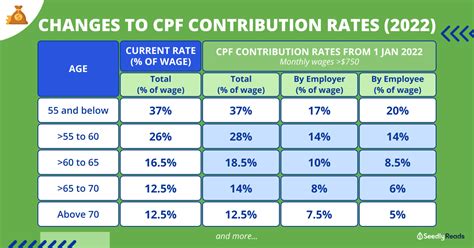

What Is the CPF Contribution Rate?

20% VS 25% Contribution Rate: CPF Contribution Rate 2025 The CPF (Central Provident Fund) contribution rate in Singapore is not a fixed rate. It is determined by a number of factors, including the age of the employee, their salary, and their citizenship status. CPF Contribution Rates for Employees Age Citizen/PR Foreign Worker Below 55 years…

How to Withdraw Money from CPF in 5 Simple Steps (2025)

Are you wondering how to access your Central Provident Fund (CPF) savings? Whether it’s for purchasing a home, funding your retirement, or meeting other financial needs, withdrawing money from CPF is a straightforward process. Here’s a step-by-step guide to help you seamlessly withdraw your CPF funds: Eligibility Criteria Before you proceed with the withdrawal process,…