The Current State of the Financial Markets: 2023 vs. 2025

Introduction

The global financial markets have experienced significant shifts and volatilities in recent years. As we approach 2025, it is crucial to assess the current state of the markets and anticipate potential trends that may shape the future. This comprehensive analysis will delve into the key market indicators, economic factors, and geopolitical influences that are driving the current financial landscape.

Key Market Indicators

Stock Markets

Global stock markets have witnessed a rollercoaster ride in the aftermath of the COVID-19 pandemic. Key stock indices, such as the S&P 500 and FTSE 100, reached record highs in 2021, driven by unprecedented monetary stimulus and economic recovery. However, concerns over rising inflation, interest rate hikes, and geopolitical uncertainties have sparked market volatility in 2023.

Figure 1: Global Stock Market Performance

| Index | 2021 High | 2023 Low | % Change |

|---|---|---|---|

| S&P 500 | 4,818.62 | 3,639.68 | -24.4% |

| FTSE 100 | 7,693.10 | 6,847.64 | -10.9% |

| Nikkei 225 | 30,795.18 | 26,112.69 | -15.2% |

Bond Markets

Bond markets have also experienced volatility, with interest rates rising in response to inflation concerns. The yield on the U.S. 10-year Treasury bond, a widely watched benchmark, surged from 1.56% in January 2022 to 3.91% in October 2023. This increase in interest rates has made borrowing more expensive for businesses and consumers, dampening economic activity.

Figure 2: U.S. 10-Year Treasury Bond Yield

| Date | Yield | % Change |

|---|---|---|

| January 2022 | 1.56% | – |

| October 2023 | 3.91% | +151.9% |

Currency Markets

Currency markets have fluctuated amidst geopolitical turmoil and economic imbalances. The U.S. dollar has strengthened against most major currencies, supported by higher interest rates and safe-haven flows. However, the British pound and euro have come under pressure due to economic headwinds and political uncertainties.

Figure 3: U.S. Dollar Index

| Date | Value | % Change |

|---|---|---|

| January 2022 | 96.50 | – |

| October 2023 | 113.20 | +17.4% |

Economic Factors

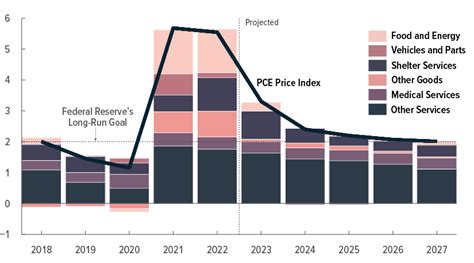

Inflation

Inflation has emerged as a major concern for central banks and governments worldwide. Surging energy and food prices, coupled with supply chain disruptions, have pushed inflation rates to multi-decade highs. The International Monetary Fund (IMF) estimates global inflation to reach 8.8% in 2023, significantly higher than the pre-pandemic average of 3.5%.

Interest Rates

In response to persistent inflation, central banks have embarked on aggressive interest rate hikes. The Federal Reserve (Fed) has raised its benchmark interest rate by 300 basis points in 2023, bringing it to the highest level since 2008. Similar measures have been taken by the Bank of England and European Central Bank.

Economic Growth

The global economy has slowed in 2023, reflecting the impact of inflation, higher interest rates, and geopolitical uncertainties. The IMF forecasts global GDP growth to decline to 3.2% in 2023, down from 6.0% in 2022. Advanced economies are expected to experience slower growth, while emerging markets face challenges related to high inflation and currency depreciation.

Figure 4: Global Economic Growth Forecast

| Year | GDP Growth | % Change |

|---|---|---|

| 2022 | 6.0% | – |

| 2023 | 3.2% | -46.7% |

| 2024 | 2.7% | -16.7% |

Geopolitical Influences

Russia-Ukraine War

The ongoing conflict between Russia and Ukraine has had a profound impact on global energy and commodity markets. Sanctions imposed on Russia have disrupted energy supplies and sent oil and gas prices soaring. The war has also created significant uncertainty and risk aversion in financial markets.

China-Taiwan Tensions

Heightened tensions between China and Taiwan have raised concerns over potential military conflict and disruptions to global trade. Taiwan’s semiconductor industry, a key supplier to the global electronics industry, could be particularly vulnerable in the event of an escalation.

U.S.-China Trade Relations

U.S.-China trade relations remain strained, with ongoing tariffs and geopolitical competition. The relationship between these two economic powerhouses continues to cast a shadow over global economic and financial markets.

Future Trends

Market Volatility

Market volatility is likely to remain elevated in the near term as investors navigate uncertainty and react to ongoing economic and geopolitical developments. Central bank policy decisions, inflation expectations, and consumer spending patterns will be key factors influencing market sentiment.

Interest Rates and Economic Growth

The path of interest rates will be closely watched in 2025, as central banks seek to balance the fight against inflation with support for economic growth. The ability of central banks to bring inflation under control without triggering a recession will be crucial for market stability.

Geopolitical Risks

Geopolitical risks, such as the Russia-Ukraine war and China-Taiwan tensions, will continue to weigh on financial markets. Investors will need to monitor these developments closely and consider the potential impact on their portfolios.

Digital Currencies

The rise of digital currencies, such as Bitcoin and Ethereum, has gained increasing attention and could potentially disrupt the financial landscape in 2025. The adoption and regulation of digital currencies will be a key topic to watch.

Conclusion

As we approach 2025, the financial markets face a complex and uncertain landscape. Rising inflation, interest rate hikes, geopolitical tensions, and digital disruption will continue to shape market dynamics. Investors need to stay informed, adapt to changing circumstances, and carefully manage risk to navigate this volatile environment. By understanding the current state of the financial markets and anticipating future trends, investors can position their portfolios for long-term success.

FAQs

- What is the outlook for the global economy in 2025? The global economy is expected to face challenges in 2025, including ongoing inflation, slowing growth, geopolitical risks, and digital disruption.

- What factors will drive market volatility in 2025? Interest rate decisions, inflation expectations, geopolitical events, and digital currency adoption will be key factors influencing market volatility.

- How will central banks balance inflation and economic growth in 2025? Central banks will need to carefully adjust interest rates to bring inflation under control while supporting economic growth.

- What is the potential impact of digital currencies in 2025? Digital currencies have the potential to disrupt the financial landscape by providing new ways of making payments, storing value, and facilitating cross-border transactions.

- What are the key risks to watch in 2025? Geopolitical risks, such as the Russia-Ukraine war and China-Taiwan tensions, as well as digital currency regulation, will be key risks to monitor.

- How can investors prepare for the financial markets in 2025? Investors should stay informed about market trends, diversify their portfolios, and consider the potential impact of rising interest rates, geopolitical risks, and digital disruption.

- What are the highlights of the current financial market landscape? Key highlights include rising inflation, interest rate hikes, geopolitical uncertainties, and the emergence of digital currencies.

- How can investors stand out in the current financial market environment? Investors can stand out by staying informed, adapting to changing circumstances, and taking a proactive approach to managing risk.