What Is the CPF Contribution Rate?

20% VS 25% Contribution Rate: CPF Contribution Rate 2025

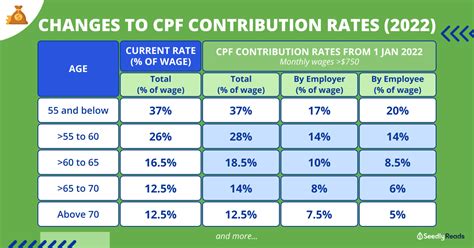

The CPF (Central Provident Fund) contribution rate in Singapore is not a fixed rate. It is determined by a number of factors, including the age of the employee, their salary, and their citizenship status.

CPF Contribution Rates for Employees

| Age | Citizen/PR | Foreign Worker |

|---|---|---|

| Below 55 years | 20% | 10% |

| 55 to 65 years | 22% | 12% |

| 65 to 70 years | 8% | 10% |

CPF Contribution Rates for Employers

| Age | Citizen/PR | Foreign Worker |

|---|---|---|

| Below 55 years | 17% | 8% |

| 55 to 65 years | 13% | 10% |

| 65 to 70 years | 8% | 10% |

CPF Contribution Rates: A Detailed Breakdown

The CPF contribution rate for employees is divided into two parts: the employee’s own contribution and the employer’s contribution. The employee’s own contribution is deducted from their salary before taxes. The employer’s contribution is paid by the employer on top of the employee’s salary.

Employee’s CPF Contribution Rate

The employee’s CPF contribution rate is 20% of their salary. However, if the employee is

- below the age of 18,

- earning less than S$5,000 per month, or

- a foreign worker,

their CPF contribution rate may be lower.

Employer’s CPF Contribution Rate

The employer’s CPF contribution rate is 17% of the employee’s salary. However, if the employee is

- over the age of 55, or

- a foreign worker,

the employer’s CPF contribution rate may be lower.

CPF Contribution Rates: The Future

The CPF contribution rate is expected to increase in the future. The government has announced that the CPF contribution rate for employees will increase to 22% in 2023 and 25% in 2025. The CPF contribution rate for employers is also expected to increase in the future, but the government has not yet announced the exact rate.

CPF Contribution Rates: Tips and Tricks

Here are a few tips and tricks to help you make the most of your CPF contributions:

- Start contributing to your CPF as early as possible. The earlier you start contributing, the more time your money will have to grow.

- Make voluntary CPF contributions. You can make voluntary CPF contributions in addition to your mandatory contributions. This is a great way to save for retirement or other financial goals.

- Take advantage of the CPF Matching Grant. The CPF Matching Grant is a government program that matches your CPF contributions up to a certain amount. This is a great way to boost your CPF savings.

- Invest your CPF savings. You can invest your CPF savings in a variety of investment products, such as stocks, bonds, and mutual funds. This is a great way to grow your CPF savings even faster.

- Combine your CPF accounts. If you have multiple CPF accounts, you may want to consider combining them. This will make it easier to manage your CPF savings and grow your money faster.

CPF Contribution Rates: Common Mistakes to Avoid

Here are a few common mistakes to avoid when making CPF contributions:

- Failing to contribute enough. The CPF contribution rate is designed to help you save for retirement. If you do not contribute enough, you will not have enough money to support yourself in retirement.

- Withdrawing your CPF savings early. Withdrawing your CPF savings early can have serious consequences. You will have to pay penalties and taxes, and you will lose out on the potential earnings that your money could have earned.

- Not investing your CPF savings. Investing your CPF savings is a great way to grow your money faster. If you do not invest your CPF savings, you will not be able to take full advantage of the CPF system.

- Not taking advantage of the CPF Matching Grant. The CPF Matching Grant is a great way to boost your CPF savings. If you do not take advantage of the CPF Matching Grant, you are missing out on free money.

- Failing to combine your CPF accounts. If you have multiple CPF accounts, combining them can make it easier to manage your CPF savings and grow your money faster.

CPF Contribution Rates: FAQs

Here are a few frequently asked questions about CPF contribution rates:

- What is the CPF contribution rate for employees? The CPF contribution rate for employees is 20%.

- What is the CPF contribution rate for employers? The CPF contribution rate for employers is 17%.

- What is the CPF Matching Grant? The CPF Matching Grant is a government program that matches your CPF contributions up to a certain amount.

- Can I withdraw my CPF savings early? Yes, you can withdraw your CPF savings early, but you will have to pay penalties and taxes.

- What is the best way to invest my CPF savings? The best way to invest your CPF savings is to choose a diversified investment portfolio that meets your risk tolerance and investment goals.

- What is the CPF contribution rate for foreign workers? The CPF contribution rate for foreign workers is 10%.